The most common ways to get health insurance are through an employer, through the government, or on your own. Let’s look at these methods and then how to sign up. It all depends on your personal situation.

Through an employer

If you have health insurance through your job, you don’t have to worry about much - your employer will provide you with an employer-sponsored group plan1. Some employers may have several insurer and plan options for you to choose from.

Sign me up

If you get married or have a baby, there’s a short window of time (usually 30 days) to add your spouse or child to your plan. Don’t miss that deadline and leave your loved one uninsured. Check with your employer to see when and how to add a dependent to your plan.

COBRA

Important Updates

- If you offer a drug plan to employees who are eligible for Medicare, you must take the following action by Oct. 15. Federal law requires you to tell your Medicare-eligible employees that their drug plan is creditable. Go to hmsa.com/creditable-drug-coverage2 for more information and to download the notice. If you have any questions, please contact your account representative or call 808-948-6377 or 1-866-726-9835.

- (IRS) posted to the Federal Register, "Extension of Certain Timeframes for Employee Benefit Plans, Participants, and Beneficiaries Affected by the COVID–19 Outbreak." 3 HMSA will adhere to the appropriate timeframe extensions related to COBRA, for those specific situations, until no longer applicable. The parameters of the COBRA law currently remain unchanged. For more information, visit the Help Center4.

June 2023:

Previously, the Biden Administration announced a definitive end to both the COVID-19 public health emergency (May 11, 2023) and the national health emergency (April 10, 2023). The U.S. Department of Labor, as allowed by the Joint Rule, subsequently exercised its discretion to determine July 10, 2023, as the end date of the Outbreak Period (60 days after the end of the public health emergency date, May 11, 2023).

- Individuals and plans with timeframes that are subject to the relief under the Notices will have the applicable periods under the Notices disregarded until the earlier of (a) one year from the date they were first eligible for relief, or (b) July 10, 2023 [the end of the Outbreak Period]. In no case will a disregarded period exceed one year.

- After July 10, 2023, the timeframes for individuals and plans with periods that were previously disregarded under the Notices will resume.

If you’ve lost your job, COBRA5 lets you stay on your employer’s health plan for a while. You may be eligible for COBRA if any of the following has happened:

- Loss of job for reasons other than gross misconduct.

- Reduced work hours below the minimum required for health plan eligibility.

- The employee enrolled in the plan dies.

- Divorce or legal separation from the employee enrolled in the plan.

- A child no longer meets the plan's eligibility rules.

COBRA lets you (and your dependents6) stay insured, temporarily and at your own expense. It’s available only at companies with 20 or more full-time employees. Contact your employer to learn how to enroll in COBRA.

Interview questions about benefitsWhen you’re interviewing for a job, remember to ask your potential employers about the kind of health plans they provide. It's an important part of your compensation package, so consider these questions before you accept the job:

- When will the health plan start?

- Who pays for the plan? If the employer and employee share costs, how is it split up?

- Are family plans7 available? Do they cover domestic partners? Who pays for family or dependent benefits?

- What health plans are offered?

- Review the health plan options and premium8 costs. Are there any deductibles9, restrictions, or limitations? Are dental, vision, or other supplemental10 options available?

- If you have a certain medical condition, does the plan pay for its treatment?

- Are FSA11, HRA12, or HSA13 benefits available?

Through the government

Medicare

Medicare is a federal program that provides basic health benefits to people 65 years or older and to certain disabled individuals. Medicare has four parts:

- Medicare Part A pays for hospital-related services and emergency care.

- Medicare Part B pays for doctor's office visits. Together, Part A and Part B are often referred to as Original Medicare.

- Medicare Part C, or Medicare Advantage14, pays for Part A and Part B benefits (at an additional cost) and may include Part D prescription drug benefits. Medicare Advantage15 plans are offered by private health insurance companies.

- Medicare part D pays for prescription drugs.

Keep in mind that Medicare doesn’t pay for all medical costs. You’ll still have to pay a portion of expenses out of your own pocket, such as premiums8, copayments16, coinsurance17, and deductibles9.

Retiring soon?18

Start planning for your health care now.

Fight Medicare fraudFraud costs us all. Learn how to detect, prevent, and report Medicare fraud, abuse, and waste from the

Department of Health19.

Medicaid/QUEST Integration

Medicaid is a joint federal-state program that provides a wide range of health plan benefits to people with low incomes or resources. Hawaii’s Medicaid program is called QUEST Integration.

On your own

Individual plans

Not everyone has health insurance through their job or the government. Many people buy health insurance on their own.

Because an employer isn’t sharing the cost of your monthly premiums, an individual health plan20 may cost more in the short term, but you’ll save in the long term. If you have to go to the hospital for any reason, services like X-rays, pain medication, and follow-up visits can cost thousands of dollars. But with a health plan, you’ll pay hundreds, not thousands. That’s big savings.

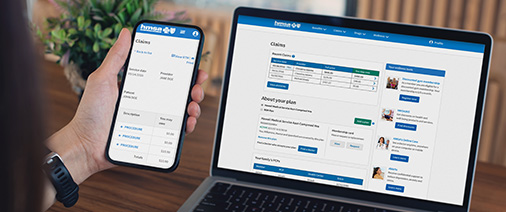

Choose from a variety of HMSA health plan options that fit your health and budget needs.

Learn more21.

Through the federal health insurance marketplace

Individuals

Individuals can get insurance directly from HMSA or through the federal health insurance marketplace at HealthCare.gov22. Depending on your financial situation, you may be eligible for financial help, which is only available through the federal marketplace.

Employees

Employees can get insurance through the federal health insurance marketplace at HealthCare.gov22 if the company they work at got its group plan there. If they did, your employer can tell you how to enroll.