Lucky we live Hawaii. We have year-round sun, surf, and the Hawaii Prepaid Health Care Act. This 1974 state law requires private employers in the state to provide approved health insurance for their employees who work at least 20 hours per week for four weeks in a row. See the Hawaii Department of Labor and Industrial Relations website for details. In addition to offering an approved plan, there are other requirements as stated below.

Premiums

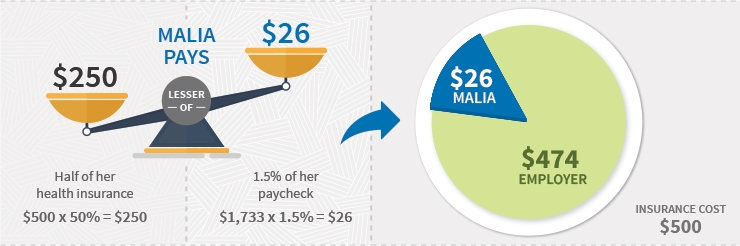

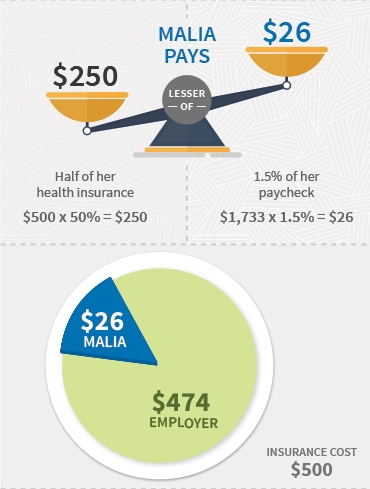

Employers may pay the entire cost of the health insurance premium or share the cost with their employees. Except for certain union agreements, the law requires employers to contribute at least half of the premium cost for single coverage. The employee must contribute the rest as long as their share is not more than 1.5% of their wages.

Here’s an example: Malia works 40 hours a week. Her monthly paycheck is $1,733. Her health insurance costs $500 a month, half which is $250, 1.5% of her net salary is $26. According to the law, Malia pays the lesser of the two amounts — $26. Her employer pays the rest.

This means your employees probably pay less for health care coverage on average than people on the Mainland because as their employer, you pay at least half of the insurance cost.

Premium payments while hospitalized

If employees are hospitalized or can’t work because of illness, employers will continue paying the same amount toward their premium. To find out how long employers will pay premiums, contact HDLIR.

Waiving medical coverage

If an employee wishes to waive medical coverage, they must submit an HC-5 Waiver form to their employer, The form can be found on the State of Hawaii Disability Compensation Division website. The employer is responsible for filing the document with the DLIR. This exemption is good until the end of the calendar year and must be renewed every Dec. 31.

Plans

Medical plans must meet minimum standards and are filed and approved annually. Hawaii law establishes that plan requirements are determined by the plans in the state with the largest membership (the “prevalent plan”). The prevalent free choice plan is an HMSA plan. That plan’s summary of benefits can be found on the DLIR website.

HMSA updates our prevalent plan every year to keep up with any health care trends and new laws to ensure that our members are receiving the best, most up-to-date, and compliant health plans.

Choose HMSA

By offering an HMSA plan, you know that your plan will be an approved, compliant Hawaii Prepaid Health Care plan and that your plan will remain current with changes made to the state prevalent plan. In addition, you’ll have access to the Blue Cross and Blue Shield network across the U.S. and around the world.

HMSA has a dedicated National Account team, which specializes in working with employers headquartered outside of Hawaii. You’ll also have access to HMSA experts who can assist with navigating the Hawaii Prepaid Health Care Act and its challenges. HMSA serves many large and small employers who do business across the country.

This overview of recent federal guidance is provided as a courtesy for general informational purposes only, may not reflect the most up-to-date information, and does not and is not intended to constitute business or legal advice. You should consult your legal adviser for more information.

- Frequently Asked Questions About Prepaid Health Care

- Highlights of the Hawaii Prepaid Health Care Law [PDF]